Tether says it would not freeze sanctioned Tornado Cash addresses unless instructed by law enforcement

“In our dealings with law enforcement we are sometimes specifically instructed not to freeze addresses as this could alert suspects,” says Tether.

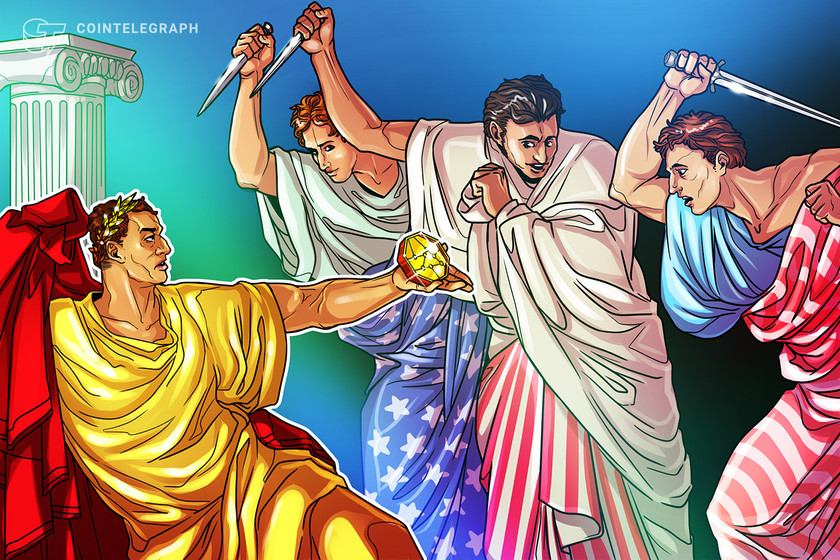

On Wednesday, U.S. dollar stablecoin issuer Tether (USDT) said that it would not freeze smart contract addresses sanctioned by the U.S. Office of Foreign Assets (OFAC) Control’s Specially Designated Nationals and Blocked Persons (SDN) list for cryptocurrency trail-mixer Tornado Cash. In explaining the decision, Tether said:

“So far, OFAC has not indicated that a stablecoin issuer is expected to freeze secondary market addresses that are published on OFAC’s SDN List or that are operated by persons and entities that have been sanctioned by OFAC. Further, no U.S. law enforcement agency or regulator has made such a request despite our near-daily contact with U.S. law enforcement whose requests always provide precise details.”

Tether pointed out that unilaterally freezing wallet or smart contract addresses could be a “highly disruptive” and “reckless” move. “It could alert suspects of an impending law enforcement investigation, cause liquidations or abandonment of funds and jeopardize further evidence gathering,” the issuer said.

All U.S. persons and entities are prohibited from interacting with the digital currency mixer’s USDC and Ethereum smart contract addresses on the SDN list, subject to stiff criminal penalties for violation. However, Tether is a Hong Kong-based issuer and neither onboards U.S. persons as customers nor conducts business in the United States, although it voluntarily follows certain U.S. regulations as a part of compliance.

Tether also expressed reservations regarding USD Coin issuer Circle’s decision to unilaterally freeze Tornado Cash smart contract addresses earlier this month. “If made without instructions from U.S. authorities, the move by USDC to blacklist Tornado Cash smart contracts was premature and might have jeopardized the work of other regulators and law enforcement agencies around the world,” says Tether. The firm points out that other stablecoin issuers based in the U.S., such as Paxos and Dai, did not freeze any Tornado Cash wallets. The sanctions went into effect on August 8.