Blockstream targets continued Bitcoin miner surplus with Series 2 BASIC Note

Blockstream CEO Adam Back says 2023 presented a unique investment opportunity with Bitcoin’s price doubling amid low ASIC miner prices on secondary markets.

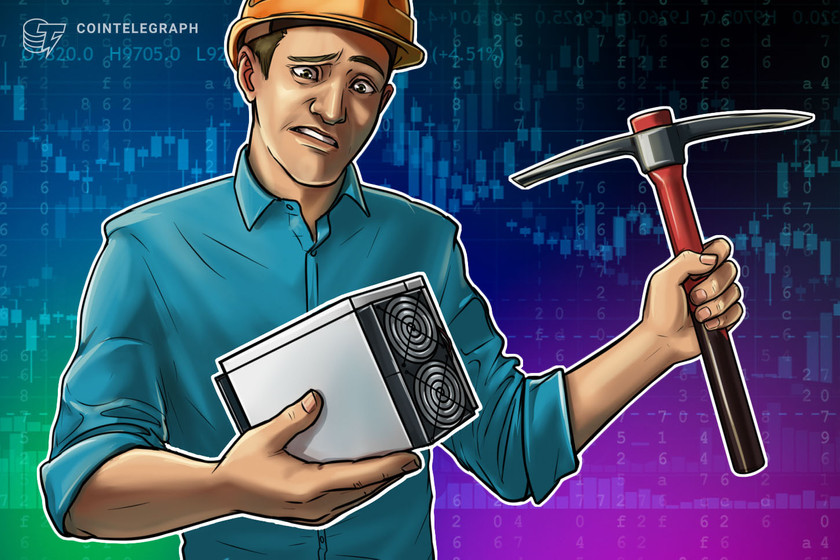

Blockstream will look to raise more capital to buy Bitcoin (BTC) mining hardware through a second series of its Blockstream ASIC (BASIC) Note offering, which aims to accumulate and sell ASICs based on the predicted demand for miners over the next two years.

Speaking exclusively to Cointelegraph, Blockstream CEO Adam Back highlighted a surplus of Bitcoin mining hardware on the secondary market as a critical driver for a second series of its investment offering.

Blockstream wound up an initial $5-million raise, which saw the firm purchase unused, boxed Antminer S19k Pro ASIC miners for $4.87 million. The company managed to secure the hardware, one of the Chinese manufacturer’s most popular miners, through SunnySide Digital.