Celsius Custody customers finally begin withdrawals 263 days after freeze

Celsius users with funds held in its custody program have finally begun to withdraw funds, but users report delays due to a backlog of requests.

Some Celsius customers have reported being able to withdraw funds from the bankrupt crypto firm for the first time, some 263 days after the lender froze withdrawals in the lead-up to its bankruptcy filing.

According to numerous social media posts, as of March 2, certain customers who held funds in Celsius’ Custody accounts have been overjoyed that they were finally able to withdraw their funds from the lender.

Glad to be one of the few to get their money back in almost one piece. Hoping everyone else will receive theirs in due time

— richieroyce.eth (@Richie_Royce) March 2, 2023

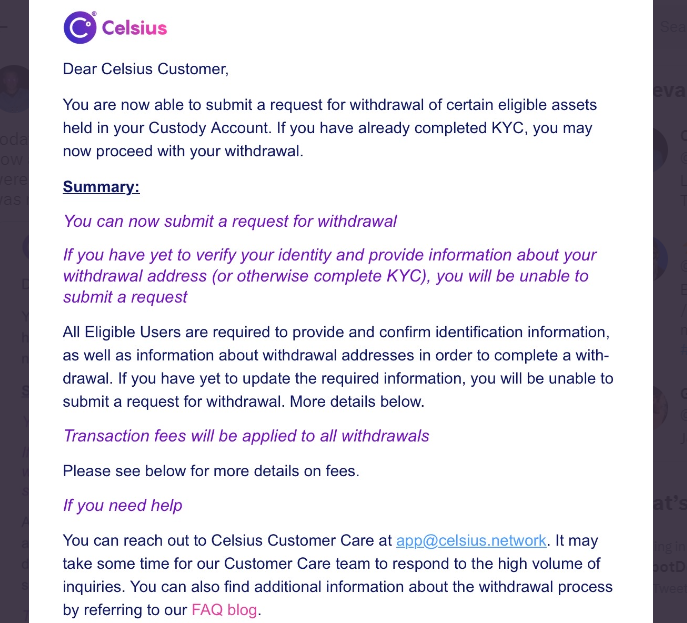

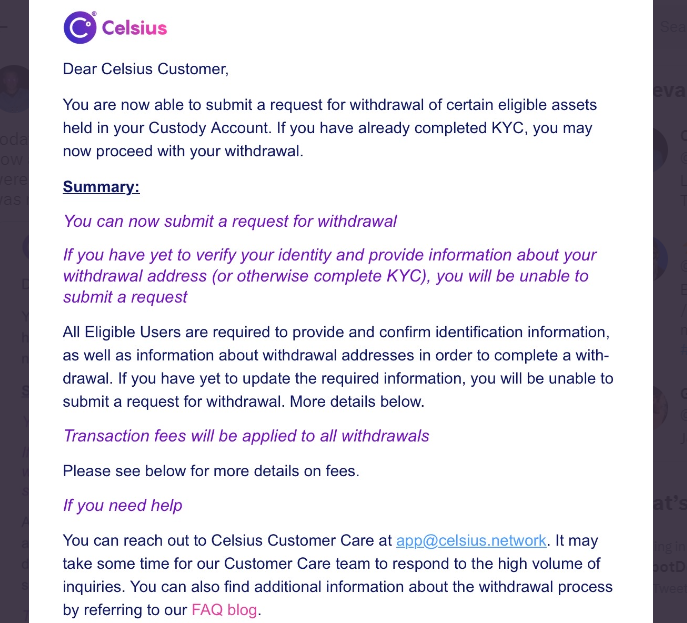

Customers report they received an email a few weeks ago listing those who were eligible to remove their funds, before receiving another on March 2 noting withdrawals could be processed.

While some users who whitelisted wallets ahead of their withdrawal attempt received their funds within minutes, others pointed to large delays.

A backlog of withdrawal attempts seems to have built up, however, with some claiming that withdrawal requests are being converted into support tickets that could take some days to process as a result of “too many requests and not enough staff.”

On Jan. 31, Celsius published details on who was eligible to withdraw, with customers who had only ever held funds in custody accounts able to currently withdraw 94% of their original funds.

The custody accounts were only available to United States residents. The withdrawals are restricted to these customers, much to the disappointment of customers with funds in other accounts offered by Celsius.

Related: Wrapped Bitcoin supply drops to negative after 11,500 wBTC burn linked to Celsius

Custody account holders may yet be able to get back the other 6%, pending future court hearings.

Customers who had transferred funds from the earn or borrow programs to a custody account are apparently able to withdraw 72.5% of their funds at this point in time, up to a maximum of $7,575.

The lender had first announced they would be freezing withdrawals on June 13, citing “extreme market conditions,” before filing for bankruptcy on July 13.