DeFi abandons Ponzi farms for ‘real yield’

Decentralized finance is beginning to embrace a hot new phrase: real yield. It refers to DeFi projects that survive purely on distributing the actual revenue they generate rather than incentivizing stakeholders by handing out dilutionary free tokens.

Where does this real yield come from? Are fees really a sustainable model for growth at this early stage?

It depends on who you ask.

The DeFi ponzinomics problem is our natural starting point.

Ponzi farming

DeFi started to arrive as a concept in 2018, and 2020s DeFi summer saw market entrants DeGens piling headfirst into DeFi to early mind-blowing returns of 1,000% a year for staking or using a protocol. Many attributed the real explosion of interest in DeFi to when Compound launched the COMP token to reward users for providing liquidity.

But these liquidity mining models were flawed because they were based on excessive emissions of protocols native tokens rather than sharing organic protocol profits.

Liquidity mining resulted in unsustainable growth, and when yields diminished, token prices dropped. Depleting DAO treasuries to supply rewards programs or simply minting more and more tokens for new joiners looked like a Ponzi scheme. Known as yield farming to some, others preferred to call it ponzinomics.

While recognizing these returns were unsustainable, many sophisticated investors became enthralled with staking (locking up tokens for rewards). One VC told me they paid for their lifestyle by staking tokens during 20202021 even knowing it was akin to a Ponzi scheme about to collapse.

The dangers of unsustainable yields were seen in mid-2022, when the DeFi ecosystem and much of the rest of crypto were gutted in a handful of days. Terras DeFi ecosystem collapsed with grave contagion effects. Its founder, Do Kwon, is wanted by South Korean authorities and is subject to an Interpol red notice but says he is not on the run. High-profile hedge fund Three Arrows Capital (3AC), which heavily invested in Terra, was liquidated in June 2022.

The reality is that returns based on marketing dollars are fake. Its like the Dotcom boom phase of paying customers to buy a product, says Karl Jacob, co-founder of Homecoin.finance of Bacon Protocol a stablecoin backed by United States real estate.

20% yield how is that possible? Marketing spend or digging into assets are the only way to explain those returns. This is the definition of a Ponzi scheme. For an investor, high yield indicates a tremendous amount of risk.

Henrik Andersson, chief investment officer of Apollo Capital, notes the yield in Terra wasnt actually coming from token emissions. I wouldnt call Terra a Ponzi scheme even though the yield wasnt sustainable; it was essentially marketing money, he says.

Real yield enters the chat

Its easy to be cynical, then, when the phrase real yield started to emerge to popular applause recently. Bankless analyst Ben Giove wrote recently, DeFi isnt dead. There are real, organic yields out there, in a piece explaining that real yields are opportunities for risk-tolerant DeFi users to generate yield at above market-rates through protocols such as GMX, Hop, Maple and Goldfinch. With the bulk of their yield not coming from token emissions, it is also likely that these protocols will be able to sustain their higher returns for the foreseeable future.

Real yield is a hashtag reaction to Terra LUNAs collapse, but that means people agree more on what it isnt than on what it actually is, argues Mark Lurie, founder of Shipyard Software, which operates a retail-focused DEX, Clipper.exchange.

Ive been on the real yield train for a year and a half and Im glad someone is paying attention. He says there are a few potential definitions, but sustainable returns on capital is one that actually makes sense.

An example of real yield is interest on a loan, like Compound Finance. Another example is fees charged on transactions and returned to capital providers e.g., gas fees in proof-of-stake layer 1s, trading fees in DEX protocols.

Manufactured narratives

Jack Chong, who is building Frigg.eco to bring financing to renewable energy projects, says there are a lot of manufactured narratives in the crypto space. Real yield is one of them, he posits.

The meaning of real yield depends on which corner of crypto you sit in, and theres two variants, says Chong, an Oxford graduate and Hong Kong native. One definition suggests that real yield is a protocol that has cash flow. It is a digital native cash flow denominated in ETH or crypto.

In other words, its a business model that has revenue.

The exact wording of many threads on Twitter is that real yield is staking for cash flows. The distinction is the source of that yield a lot of crypto ecosystems are self-reflexive, Chong argues, referring to the digital money circulating and creating gains for investors without coming from actual revenue, like Terra.

Linguistically, real yield doesnt have to be about trading protocols, he continues. The other meaning is yield from real world assets. An example is a rental return from a tokenized piece of real estate, such as a fractionalized city car space split among investors.

Chong, who founded a biotech startup and once studied Arabic in Jordan with diplomacy in his sights, has a mission to deploy crypto for productive use. Any North Star for any financial system should be to deploy capital and make a profit. The whole real yield story is just common sense in TradFi, he points out.

Real yield is of course linguistically disparaging of all that came before it as fake yield. So, what are these yields?

Real yield: Interest and fees

Real yield can involve lending and borrowing models in which higher risk equates to higher interest rates for borrowers and, consequently, higher yields for lenders. Thats the model of the under-collateralized lending platform and real yield pin-up boy Maple Protocol.

Maple enables institutions, such as market makers or VCs, to take out under-collateralized loans via isolated lending pools. A pool delegate assesses the risk of a borrowers creditworthiness. To date, Maple has originated $1.8 billion in loans and recently launched a $300-million lending pool for Bitcoin mining firms.

Interest from loans (or usury) is an obvious but lucrative business model. Banks mostly make money from loans.

One of the most obvious sources of real yield is providing tokenholders with a slice of the revenue generated by fees imposed on users of the platform. In other words, there is an actual product or service earning revenue.

Jacob, an OG dating back to Web1, argues that proof-of-work staking returns on Ethereum now incorporate real yield.

ETH could be considered a real yield. With Eth1, most money flowed to miners proof-of-work (or mining transactions to prove their validity) was a kind of real yield already. Miners were getting real yield. Now stakers are able to earn yield from network transactions. Transactions happen often, and a lot of more people get paid. For every transaction, ETH stakers make money.

In other words, transactional revenue is a reward for ecosystem building.

Others are joining the real yield trend or emphasizing that part of their protocol.

Synthetix is a highly successful decentralized protocol for trading synthetic assets and derivatives. Tokens on that platform are actually synthetic assets designed as a tokenized representation of investment positions.

Its too complicated to explain here, but the elevator pitch is that users stake the native token SNX to mint the stablecoin SUSD, which underpins all the liquidity and other tokens on the platform. Stakers are handsomely rewarded with token emissions sometimes over 100% APY as well as a cut of the SUSD fees paid by traders to use the platform.

All of a sudden this year, SUSD fee revenue went through the roof when 1inch and Curve realized they could use Synthetixs synthetic assets for no slippage trading between things like BTC and ETH.

As a result, Synthetix is now considering a proposal by founder Kain Warwick to stop inflationary rewards and move to rewarding stakers based entirely on real trading fees.

Thats the very definition of real yield. It will be interesting to see if their real revenue is enough to incentivize stakers on the fairly risky and complicated platform.

But how does this all succeed in a bear market?

Impermanent loss and other risks

Another way fees might be earned for providing liquidity is to assist in cross-blockchain liquidity. Liquidity providers risk facing exposure to the price volatility of the underlying asset they are providing liquidity for. Impermanent loss happens when the price of your deposited assets changes from when you deposited those assets. This means less dollar value at the time of withdrawal than when deposited. So, your rewards or headline real yield from staking liquidity may be offset by the losses upon withdrawal.

Lurie says:

Ponzi yields may be defined as the unsustainable granting of speculative tokens. But yields from protocol transaction fees can also be fake if the underlying economic model is unsustainable. For example, liquidity providers to SushiSwap earn fees from transactions, but typically lose more to impermanent loss than they make from fees, which means they are losing money.

The important thing, obviously, is income minus expenses, says Lurie. The biggest problem in DeFi is that actual gains are complex to measure because of the concept of impermanent loss, Lurie tells Magazine. This is the greatest trick in DeFi, he says.

Protocols that are fundamentally unsustainable make themselves seem profitable by relabeling revenue from fees as yield and relabeling loss in principal as impermanent loss.

Naturally, they advertise revenue (which can only be positive) while claiming that losses are impermanent and/or hard to measure. At the end of the day, real yield should mean profits to capital providers. Focusing on revenue without expenses is just the Ponzi principle in another form.

Traditional investors like real yield

Real yield has emerged due to current investment cycles and market conditions. Chong points out, Real yield more closely reflects TradFi and has a lot to do with the cycle of market participants.

During the DeFi summer, hedge funds acted as speculative vultures. Now institutional investors like Goldman Sachs are looking for new directions in crypto on what will survive the bear market. Others such as Morgan Stanley, Citigroup and JP Morgan are all watching closely and writing their own reports on crypto.

Apollos Andersson notes that real yield means that while there were historically wide question marks around the value of crypto assets, since 2020, protocols that generate revenue as on-chain cash flow are not that different from equities in that sense.

He defines real yield as on-chain derivatives protocols with profit to earnings multiples that make sense, without incentives like liquidity mining.

Traditional investors like real yield because it enables them to use traditional metrics like price-to-earnings ratio (P/E ratio) and discounted cash flow (DCF) to value whether a token is cheap or expensive and whether its worth investing in.

The P/E ratio is a stock (or token) price divided by the companys earnings per share for a designated period like the past 12 months. DCF refers to a common valuation metric that estimates the value of an investment based on its expected future cash flows.

The transparency of blockchain revenue also provides a stream of data to constantly update decisions thanks to protocols like Token Terminal and Crypto Fees. In crypto, you dont have to wait for a quarterly statement like stocks, says Andersson. Revenue minus or divided by the newly minted token for incentives can generate cleaner numbers, he suggests. Real yield is revenue without incentivizing volume, such as in the cases of Uniswap and GMX.

Yet Andersson cautions investors that in crypto, income and revenue can be very similar, as the cost base looks very different than for a traditional company. This makes yield for crypto protocols highly attractive in comparison. But cost bases and margins can be higher in crypto as there is often an initial distribution of tokens when a project launches. He asks:

What is the protocols revenue compared to the value of the tokens minted? is the question.

Will the real yield trend stay?

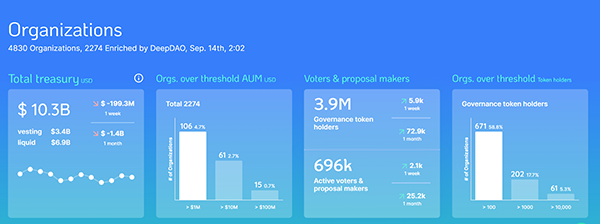

The real yield trend shows that DeFi is maturing and beginning to act like genuine businesses. Its also growing in popularity.

One way to validate a DeFi protocols use case can be to assess if it has been forked by other founders looking to leverage the original code and design, says Apollo Capital VC analyst David Angliss.

In this case, protocols such as Gains Network, Mycelium.xyz and MadMeX are all replicating GMX, by offering real yields to stakers in the form of fees earned via swaps and trading on a decentralized derivatives trading platform.